What is workers compensation Benefits insurance?

Workers’ compensation insurance provides benefits if an employee is injured or becomes ill on the job. Laws and benefits related to workers compensation Benefits insurance vary from state to state, but in most cases, companies with employees are required to have insurance.

Workers compensation benefits insurance This insurance not only helps employees, but also reduces liability for work-related injuries and illnesses. For more information, visit our Workers Compensation Benefits by State page.

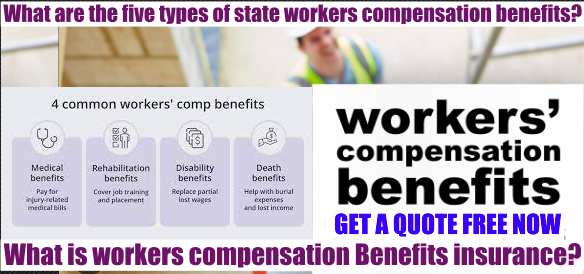

What are the five types of state workers compensation benefits?

If an employee suffers a work-related injury or illness, workers’ compensation benefits may cover the following

- Medical expenses for treatment of the injury

- Ongoing care to recover from the injury and return to work; and

- Death and funeral expenses if the employee dies

- Time off work benefits if the employee takes time off from work to recover

- Disability benefits if the employee is totally or partially disabled on the job.

Keep in mind that workers’ compensation benefits are not available if the employee is

- Injured off the job; or

- If the employee was intoxicated during the accident.

- Intentionally caused the injury.

Medical expenses

If a worker is injured on the job, workers’ compensation can cover the cost of his or her medical treatment. For example, if an employee continues to develop carpal tunnel syndrome and requires medical treatment, workers’ compensation would cover

Loss of Wages.

If an employee is injured or becomes ill on the job and is unable to return to work immediately, workers’ compensation can help pay for lost wages during that time. These payments are a percentage of the employee’s average weekly wage.

Continuing Care

Employees can easily develop repetitive stress injuries such as carpal tunnel or bursitis from sitting in front of a computer all day. Workers’ compensation can help pay for ongoing medical expenses such as physical therapy.

Death Benefits

If an employee loses his or her life on the job, workers’ compensation can help pay death benefits to the family, including funeral expenses.

Disability Benefits

Workers’ compensation can help pay disability benefits to an employee with a work-related total or partial disability.

How much workers compensation benefits can I get?

Workers Compensation Benefits Employees are entitled to workers’ compensation benefits immediately following an accident. The exact benefit amount depends on

The size of the business. Salaries are eligible for compensation. The more employees you have working in your business, the more compensation you will need.

The risks your employees face. This is because working in an industry with more risks means you must provide more coverage. For example, construction workers, roofers, and steel framers are higher risk jobs than retail workers, salespeople, and teachers.

The state in which the business is located has different regulations. Some state laws require businesses to be compensated a certain amount.

These factors affect small businesses differently. Our insurance specialists can help you calculate the amount of compensation needed to protect your employees. We can answer any questions you may have about workers’ compensation insurance.

What are the prerequisites for accepting laborers’ remuneration benefits?

What are workers’ compensation benefits? In order to receive workers’ compensation benefits, certain steps must be taken by the employer and employee to file a claim. Keep in mind that the federal government does not oversee workers’ compensation requirements; each state does. This means that the steps you must take may vary depending on where you live.

Generally, the sooner a claim is filed, the sooner benefits will begin. Also note that some states require companies to pay benefits before claims are processed. Therefore, the longer it takes to file a claim, the longer the company is responsible for paying the sick or injured worker’s insurance benefits.

That is why it is important to know how to file a workers’ compensation claim and to do so immediately. Knowing how to file a workers’ compensation claim can save you time and money. The information you will need to file a claim is as follows

- Business name

- Insurance policy number

- Account number

- Location code

Personal information of the injured employee:

- Social Security Number

- Date of Birth

- Address

- Marital status

- Age

- Gender

- Date of employment

- Number of years in current position

- Wage information

Incident Details:

- Date

- Address

- Type of injury

- Estimated days of recovery

- Injured body part

- Reason for the alleged injury

- Witnesses

In the event that your representative is associated with a specialists’ pay mishap or turns out to be sick at work, document a case with The Hartford on the web or call 800-327-3636.