Cheapest Home Insurance. According to NerdWallet’s analysis, among major insurance companies, State Farm home insurance is the cheapest, averaging $1,500 per year.

You don’t have to choose between good coverage and affordability when insuring your home. Cheap homeowners insurance also includes excellent coverage.

NerdWallet analyzed pricing data from over 100 insurance companies to find the cheapest homeowners insurance companies in the country. Our sample policy is for a 40-year-old homeowner with good credit, $300,000 in home coverage, $300,000 in liability coverage, and a $1,000 deductible. Your premiums will vary.

Cheapest Homeowners Insurance from Large Companies

NerdWallet looked at the average rates of the largest insurance companies in the U.S. to find out which ones have the lowest premiums.

Use the table below to see the average annual premiums of the three cheapest large companies, along with NerdWallet’s star ratings. To learn more about each insurance company, select the company name.

Learn more about the cheapest homeowners insurers

Find out more about the cheapest leading insurance companies and see if they are right for you.

Company Overview As the largest homeowners insurer in the country, State Farm stands out for its financial strength and many coverage options. In addition, according to the National Association of Insurance Commissioners, the company has received fewer complaints to state regulators than expected for an insurance company of its size.

With agents located throughout the country, State Farm is able to respond to customers individually by phone or in person. But if you prefer to do everything online, you can use the company’s website to pay claims, file claims, and get quotes.

Discounts to inquire about: Home and auto insurance bundles, protective devices such as fire and burglar alarms, and impact-resistant roof shingles.

SAMPLE RATES: Below are State Farm’s average premiums for four types of dwelling coverage. (Dwelling coverage is the portion of the policy that covers the structure of the home.)

Dwelling Coverage Amount

- Average Annual Rate

- $200,000

- $1,160

- 300,000

- $1,500

- $400,000

- $1,840

- $500,000

- $2,235

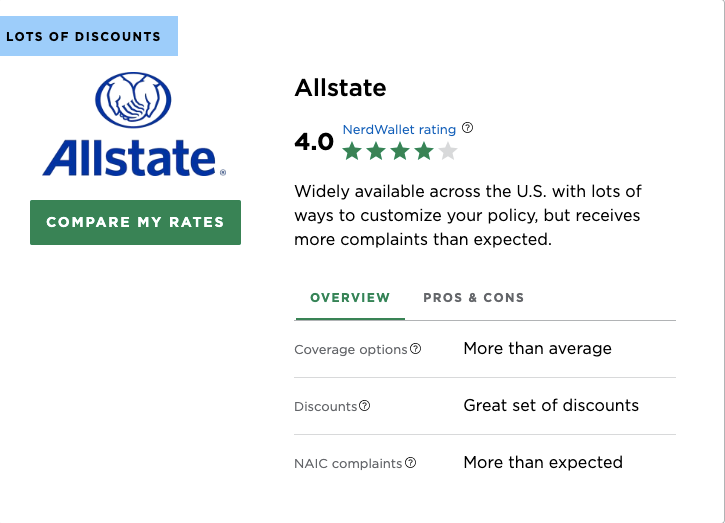

Company Description This leading insurer offers a wide range of additional coverage options beyond basic coverage. For example, if you rent out space through a service like Airbnb, you can add home sharing coverage or add coverage to pay for energy efficiency improvements after a claim. The website offers much information and useful features.

One downside to choosing Allstate’s policy: according to the NAIC, there are more complaints than expected for an insurance company of this size.

Discounts to ask about: recent homebuyers, claim-free, and auto pay.

Sample Rates Below are Allstate’s average premiums for four different home coverage amounts.

Home Coverage Amount

- Average Annual Rate

- $200,000

- $1,345

- $300,000

- $1,660

- $400,000

- $2,010

- $500,000

- $2,370

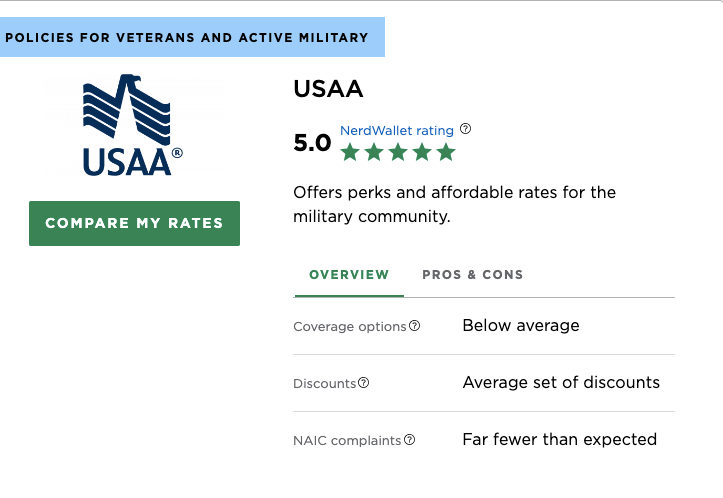

Company Overview This company sells homeowners insurance exclusively to active duty military, veterans and their families.USAA typically covers your belongings on a “replacement cost” basis. This means that if your belongings are stolen or destroyed, the policy will pay enough to purchase a new replacement without deducting depreciation. A few organizations charge extra for this kind of inclusion.

USAA covers military uniforms with no deductible. They also do not charge a deductible if your belongings are damaged or destroyed in the war.

Discounts to ask about: bundle a smart home device, loyalty, and multiple USAA policies.

SAMPLE RATES: Below are average USAA rates for four types of dwelling coverage

Dwelling Coverage Amount

- Average Annual Rate

- $200,000

- $1,370

- 300,000

- $1,775

- $400,000

- $2,130

- $500,000

- $2,470

Cheapest Homeowners Insurance Premiums in Each State

Where you live usually has a significant impact on home and property insurance premiums. How close you are to the coast, the local crime rate, and population density all affect insurance premiums. The table below shows the most affordable home insurance companies in each state and their average annual rates.

| State | Cheapest Company | Average Annual Rate |

| Wyoming | Nationwide | $1,095 |

| Wisconsin | Farmers | $725 |

| West Virginia | Westfield | $1,035 |

| Washington, D.C. | State Farm | $895 |

| Washington | Pemco | $585 |

| State of Virginia | Cincinnati Insurance | $620 |

| State of Vermon | Vermont Mutual Insurance | $480 |

| Utah | Farm Bureau Financial Services | $650 |

| Texas | Chubb | $2,250 |

| Tennessee | Westfield | $1,190 |

| South Dakota | Auto Owners | $1,420 |

| South Carolina | Chubb | $1,195 |

| Rhode Island | NLC Insurance | $830 |

| Pennsylvania | Cumberland Mutual Insurance | $445 |

| Oregon | California Casualty Insurance | $725 |

| Oklahoma | American Farmers & Ranchers | $2,895 |

| Ohio | Buckeye | $475 |

| North Dakota | Farmers Union | $1,335 |

| North Carolina | State Farm | $1,335 |

| New York | NYCM | $620 |

| New Mexico | State Farm | $1,270 |

| Nevada | Farmers | $705 |

| Nebraska | State Farm | $2,800 |

| Montana | Four Most (FOMOST) | $1,320 |

| Missouri | Auto Club of SoCal (AAA) | $1,415 |

| Mississippi | Allstate | $1,060 |

| Minnesota | Secura | $955 |

| Michigan | Meomic | $740 |

| Massachusetts | Narragansett Bay | $700 |

| Maryland | Brethren Mutual | $685 |

| Maine | Vermont | $555 |

| Louisiana | Centauri | $1,085 |

| Kentucky | Allstate | $1,560 |

| Kansas | Auto Owners | $2,195 |

| Iowa | West Bend | $1,275 |

| Indiana | Wolverine Mutual | $780 |

| Illinois | State Farm | $1,085 |

| Idaho | Grange Insurance | $725 |

| Hawaii | DB Insurance | $280 |

| Georgia | Auto Owners | $1,200 |

| Florida | People’s Trust | $1,300 |

| Delaware | Nationwide | $575 |

| Connecticut | Vermont Mutual Insurance | $745 |

| Colorado | Auto Owners | $1,285 |

| California | Travelers | $775 |

| Arkansas | State Farm | $1,650 |

| Arizona | State Farm | $915 |

| Alabama | Allstate | $1,270 |

Note: In West Virginia and Washington, D.C., USAA homeowners insurance was the cheapest on average; USAA policies are not included in the table above because they cover active duty military, veterans, and their families only.

For more information on homeowners insurance for veterans and military members, click here.

Cheapest Homeowners Insurance in 20 Major Cities

Below are the companies offering, on average, the most affordable homeowners insurance in 20 major U.S. cities.

| Cities | Cheapest Company | Average Annual Rate |

| Austin | Chubb | $1,335 |

| Charlotte | North Carolina Department of Agriculture | $1,115 |

| Chicago | State Farm | $1,050 |

| Columbus | Buckeye | $465 |

| Dallas | Chub | $1,890 |

| Denver | Auto Owners | $1,365 |

| El Paso | Chubb | $900 |

| Fort Worth | Chub | $2,045 |

| Houston | All U.S. | $1,330 |

| Indianapolis | Wolverine Mutual | $985 |

| Jacksonville | People’s Trust | $1,360 |

| Las Vegas | Farmers | $720 |

| New York City | Allstate | $755 |

| Phoenix | State Farm | $930 |

| San Antonio | Chubb | $1,530 |

| San Diego | Travelers | $670 |

| San Jose | Travelers | $555 |

Cheapest Homeowners Insurance for Different Situations

Just because an insurance company is affordable in a given situation does not mean it is always the best option, and NerdWallet looked at how different factors affect the cheapest homeowners insurance rates.

To determine the top insurers in each category, NerdWallet compared rates from companies with data from at least 15 states. We selected the five cheapest companies in each category.

Cheapest Home Insurance Cheapest Home Insurance Cheapest Home Insurance Cheapest Home Insurance Cheapest Home Insurance Cheapest Home Insurance Cheapest Home Insurance

Cheapest Home Insurance for Homeowners with Bad Credit

In most states, homeowners with bad credit can expect to pay significantly more for insurance. Below are the companies with the lowest average premiums for people with bad credit.

| Insurance Company | Average Annual Rate | Average Monthly |

| State Farm | 32,20 | $268 |

| Nationwide | $3,485 | $290 |

| All-State | $3,520 | $293 |

| American Family | $3,595 | $300 |

| USAA | $3,370 | $281 |

In California, Maryland, and Massachusetts, credits cannot be used to price homeowners, renters, condominium, or mobile home insurance.

Did you know?

Studies have shown a correlation between lower credit scores and more insurance claims. Therefore, most insurance companies charge higher premiums for lower credit scores. Learn more about how credit scores affect homeowners insurance.

Cheapest homeowners insurance for those who have recently filed a claim

Many insurance companies raise premiums after a homeowner files a claim for homeowners insurance. Below are the cheapest insurance companies for homeowners who have filed a claim for wind damage.

| Insurance Company | Average Annual Rate | Average Monthly |

| State Farm | $1,640 | $137 |

| Auto Owners | $1,725 | $144 |

| Allstate | $1,860 | $155 |

| American Family | $2,170 | $181 |

| USAA | $1,870 | $156 |

Homeowners insurance on new homes is cheaper.

New homes are generally less expensive to insure than older homes. They may be more resilient to natural disasters because they meet the latest building safety standards. In addition, new plumbing, electrical, and other systems are less likely to fail or suffer damage because they are subject to less wear and tear than older systems.

The following are the most affordable homeowner companies for new homeowners

| Company Name | Average Annual Rate | Average Monthly |

| Allstate | $865 | $72 |

| Nationwide | $895 | $75 |

| State Farm | $900 | $75 |

| USAA | $880 | $73 |

| Auto Owners | $1,060 | $88 |

Homeowners insurance with higher deductibles is cheaper.

Higher deductibles generally result in lower homeowners insurance premiums. The deductible for homeowners insurance is the amount of the claim that the insurance company will cover itself before paying the claim.

Below are the cheapest companies for homeowners insurance with deductibles of $2,500.

| Insurance Company | Average Annual Rate | Average Monthly |

| State Farm | $1,325 | $110 |

| All State | $1,430 | $119 |

| Auto Owners | $1,565 | $130 |

| Chubb | $1,715 | $143 |

| USAA | $1,590 | $133 |

Cheapest homeowners insurance for different home coverage amounts

You may need different amounts of homeowners insurance if your home’s rebuilding costs are higher or lower than the sample home.

$200,000

| Insurance Company | Average Annual Percentage | Average Monthly |

| State Farm | $1,160 | $97 |

| All State | $1,345 | $112 |

| Auto Owners | $1,355 | $113 |

| Chubb | $1,375 | $115 |

| USAA | $1,370 | $114 |

Homeowners coverage $400,000

| Company Name | Average Annual Percentage | Average Monthly |

| State Farm | $1,840 | $153 |

| All State | $2,010 | $168 |

| Auto Owners | $2,115 | $176 |

| American Family | $2,370 | $198 |

| USAA | $2,130 | $178 |

500,000 coverage for home

| Company Name | Average Annual | Average Monthly |

| State Farm | $2,235 | $186 |

| All State | $2,370 | $198 |

| Auto Owners | $2,515 | $210 |

| American Family | $2,740 | $228 |

| USAA | $2,470 | $206 |

Did you know?

Dwelling coverage is not necessarily equal to the market value of your home. Dwelling coverage amounts are based on what it would cost to rebuild your home if it were destroyed. The market worth of your home incorporates the worth of your territory and reflects what somebody might want to pay for the property. Learn more about how to determine the value of your home.

How to Get Cheap Homeowners Insurance

There are many ways to get cheap homeowners insurance for your property, although some require a little more work than others. Below are the most common ways to get cheap homeowners insurance

Shop around. Try not to purchase the main insurance contract you get a statement for.We recommend comparing premiums from at least three different companies to find the most affordable rate.

Click here to learn how to get a home insurance quote.

Get the right amount of insurance. You should not necessarily insure your home at its current market value (i.e., how much the home would sell for). All things considered, safeguard it for the sum it would cost to reconstruct.Ask your home insurance agent or insurance company to estimate the replacement cost of your home and insure your home for the appropriate amount.

” More How much property holders insurance do you need?Increase your deductible.Picking a higher deductible can cut down your premium. Just make sure you have enough cash to cover claims should they arise.

Avoid small claims. Most home insurance companies offer discounts to customers who have not filed a claim in the past three to five years. If possible, avoid raising your premiums by paying for home repairs in cash and only filing claims when absolutely necessary.

Bundle insurance. Many insurance companies offer discounts when you bundle home and auto insurance, making both policies more affordable.

Add safety features to your home. Making your home more secure now might get a good deal on your home insurance payments over the long haul. Many insurance companies offer discounts for equipment that protects your home from fire and theft. Fire extinguishers, deadbolts, and security systems can all help keep your premiums low.

Frequently Asked Questions

Where is the best and cheapest homeowners insurance?

State Farm and USAA have lower premiums than the national average and are on NerdWallet’s list of The Best Homeowners Insurance Companies. However, USAA insurance is only available to active duty military, veterans, and their families. Another major company offering inexpensive homeowners insurance is Allstate.

Will my premiums increase with homeowners insurance?

Yes, filing a claim for homeowners insurance will generally increase your premiums in the future. Therefore, it may not make financial sense to file an insurance claim for minor damages that you can pay for yourself.

Why will my homeowners insurance keep going up?

Even if you have never filed a claim, your insurance company may raise your premiums for other reasons. Inflation and supply chain issues make it more expensive to rebuild a home and more expensive for insurers to pay claims. Increasing frequency of wildfires, hurricanes, and other disasters are also driving up insurance premiums.

What is Homeowners Insurance?

Homeowners insurance provides financial assistance in the event your home is damaged or sued by someone.

Homeowners insurance is a type of insurance that you are required to purchase when you buy a home. Homeowners insurance is an important type of insurance that provides financial support in the event your home is damaged or destroyed.

What is homeowners insurance?

Homeowners insurance is a type of insurance that protects you financially against certain types of damages and lawsuits. To obtain this coverage, you pay a certain amount of money, called a premium, to the insurance company. In return, the insurance company will pay you if your home or belongings are damaged by a fire or other covered event. You may also receive financial assistance from your homeowners insurance if you injure someone else or damage someone else’s property.

- Homeowners insurance has four main features:

- Cost of repairing the home, landscaping, or other structures

- Pays for the cost of repairing or replacing personal items.

- Pays for the cost of living elsewhere while the home is being repaired.

- Covers claims and legal expenses if you cause damage or injury to others.

Is homeowners insurance required?

Homeowners insurance is not required by law, but if you have a mortgage, your lender will require you to insure your home to protect its investment. Even if you do not have a mortgage, homeowners insurance is almost always a wise purchase. Homeowners insurance, which provides coverage for homeowners’ property and liability, is a financial safety net that you may one day be glad you have.

Homeowners Insurance and Mortgage Insurance

Homeowners insurance is different from mortgage insurance, which must be purchased when the down payment on the mortgage is less than 20%. (You must purchase mortgage insurance if you have less than a 20% down payment on your mortgage (Federal Housing Administration (FHA) loans and other federal loans may also require mortgage insurance regardless of the down payment amount). If the loan defaults, mortgage insurance reimburses the lender.

Mortgage insurance protects the lender; home insurance protects you.

What does homeowners insurance cover?

Home insurance is full of fine print about what is covered and what is not. Something significant to recall is that home protection is intended to pay for unexpected, inadvertent harm.

Let’s say you wake up one morning and your water heater is not working. Standard homeowners insurance will not pay for a repairman to come out to fix it. However, if a hail storm caused a dent in your roof, your insurance would probably help pay for it.

Some accidents, even sudden ones, are excluded from insurance. For example, most homeowners insurance policies will not pay for damage caused by earthquakes or floods unless you purchase additional coverage.

For a complete guide to what insurance will and will not pay, see What Does Homeowners Insurance Cover?

Definitions of Homeowners Insurance

The accompanying definitions might assist you with better figuring out your mortgage holders insurance contract.

Standard Types of Coverage

Following are the six main parts of a homeowners insurance policy

Abiding inclusion: pays for harm to the design of the home.

Other Structure Coverage: pays for damage to structures that are not attached, such as sheds and fences.

Personal property coverage: pays for damage to your belongings: furniture, clothing, electronics, etc.

Occupancy Damage Coverage: pays for hotel, meals, and other additional expenses if you need to leave your home while repairs are being made.

Personal Liability Coverage: Provides coverage for claims and legal fees if you injure someone else or damage someone else’s property.

Medical Expense Coverage: pays for small medical expenses if someone is injured on your property or your dog bites someone, even if it is not your fault.

Other important terms

Claim: To request payment from an insurance company under an insurance policy. To file a claim, you contact the insurance company (online or by phone) and describe the extent of the damage. The insurance company assesses the claim and decides whether or not to pay the claim based on the coverage.

Declaration Page: Usually the first page of a homeowners policy. It displays important information such as the premium amount, coverage limits, and the address of the home covered by the policy.

Deductible: Deductible: The amount you pay when you file a claim. When you file a claim, the insurance company deducts this amount from the payment. The more damages you pay for yourself, the lower your homeowners insurance premiums will be.

Endorsement: An amendment that adds, changes, or deletes a homeowners policy. For example, if you pay extra for identity theft coverage, the insurance company will add an endorsement to your policy explaining the coverage.

Limit: The maximum amount of insurance coverage that will be paid. In general, homeowners insurance policies have different limits for different types of coverage. For example, the limit of coverage for the structure of the home is $300,000 and the limit of coverage for belongings is $150,000.

See more key terms to know about homeowners insurance.

See: Original Site